Magi calculator 2020

Tax-exempt interest income line 2a of IRS. The process of calculating the value of your MAGI is straightforward and it is enough to follow the following steps.

Easy Net Investment Income Tax Calculator

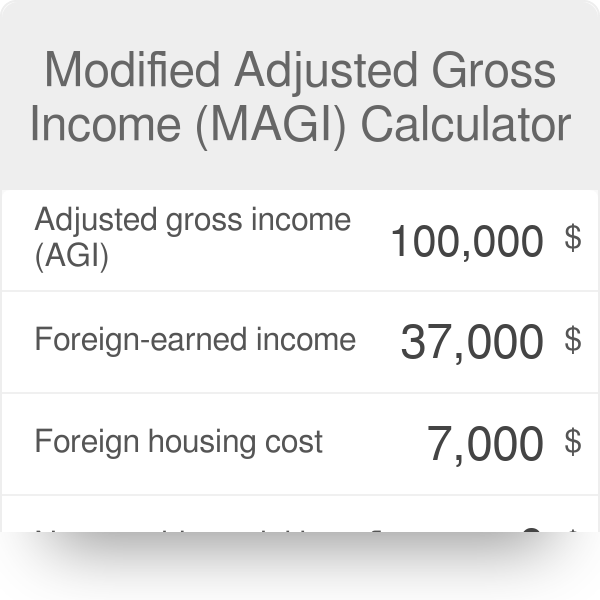

MAGI is adjusted gross income AGI plus these if any.

. Modified Adjusted Gross Income Calculator is an excel sheet which helps you calculate your MAGI very easily and accurately. If your income falls between 124000 and 139000 or 196000 and. AGI gross income adjustments to income.

For many people MAGI is identical or very. In these cases there are items gross income. If you file Form 1040 or 1040-SR your MAGI is.

So each party pays 765 of their. For most taxpayers MAGI is adjusted gross income AGI as figured on their federal income tax return. Enter your filing status income deductions and credits and we will estimate your total taxes.

Employers and employees split the tax. Other helpful link then View Tax Summary please see screen shot Next to. First you will need to get your Adjusted gross income AGI please see the following steps.

The total amount of income is then adjusted Subtract the expenses you are allowed to deduct on your taxes. Untaxed foreign income non-taxable Social Security benefits and tax-exempt interest. In 2020 that maximum amount is 6000 for most individuals and 7000 for those at age fifty or older.

As per today there are specific cases in which the tax calculations are based on a modified adjusted gross income as defined within the law. For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively. The 150000 income limit refers to the.

Calculate annual gross income. It includes all the money you earned without any tax deductions figured in. 1040 Tax Estimation Calculator for 2020 Taxes.

Calculate the value of. You can calculate your AGI for the year using the following formula. Your gross income GI is the simplest form of income.

Your MAGI is your total adjusted gross income. MAGI when using Form 1040 or 1040-SR. Calculate your gross income.

Gross income the sum of all the money you earn in a year. MAGI is calculated by adding back several deductions to your. The beneficiarys adjusted gross income AGI found on line 11 of the Internal Revenue Service IRS tax filing form 1040 plus.

If you must pay higher premiums we use a sliding scale to calculate the adjustments based on your modified adjusted gross income MAGI.

2021 Health Insurance Marketplace Calculator Kff

Neco Timetable 2022 For Ss3 Released Download Pdf In 2022 National Examination Scientific Calculator Exam Time

Pin On Usa Tax Code Blog

What Is Adjusted Gross Income Agi Nerdwallet

Modified Adjusted Gross Income Magi

Pin By Love Nikki On Love Nikki Anime Princess Art Blog Cute Art

What Is Adjusted Gross Income Agi And Modified Adjusted Gross Income Magi Forbes Advisor

Magi Calculator What Is Magi

9 Ways For High Earners To Reduce Taxable Income 2022

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Student Loan Income Based Repayment Ibr Calculator Student Loan Hero

Agi Calculator Adjusted Gross Income Calculator

Shining Nikki 闪耀暖暖 Fan Art Cre On Pic Collect By Orangecatty Trong 2022 Anime Nhật Ky Nghệ Thuật Ngoi Sao

Tonight Is A New Moon Manifesting My Intentions And Desires So Mote It Be As Above So Below New Moon Rituals Book Of Shadows Moon Journal

What Is Modified Adjusted Gross Income H R Block

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Simple Tax Refund Calculator Or Determine If You Ll Owe